Which of the following best describes the accumulation phase of an annuity. О The Present Value Of A Set Of Payments To Be Received О The Present Value Of A Set Of Payments To Be Received Apr 04 2022 0323 PM.

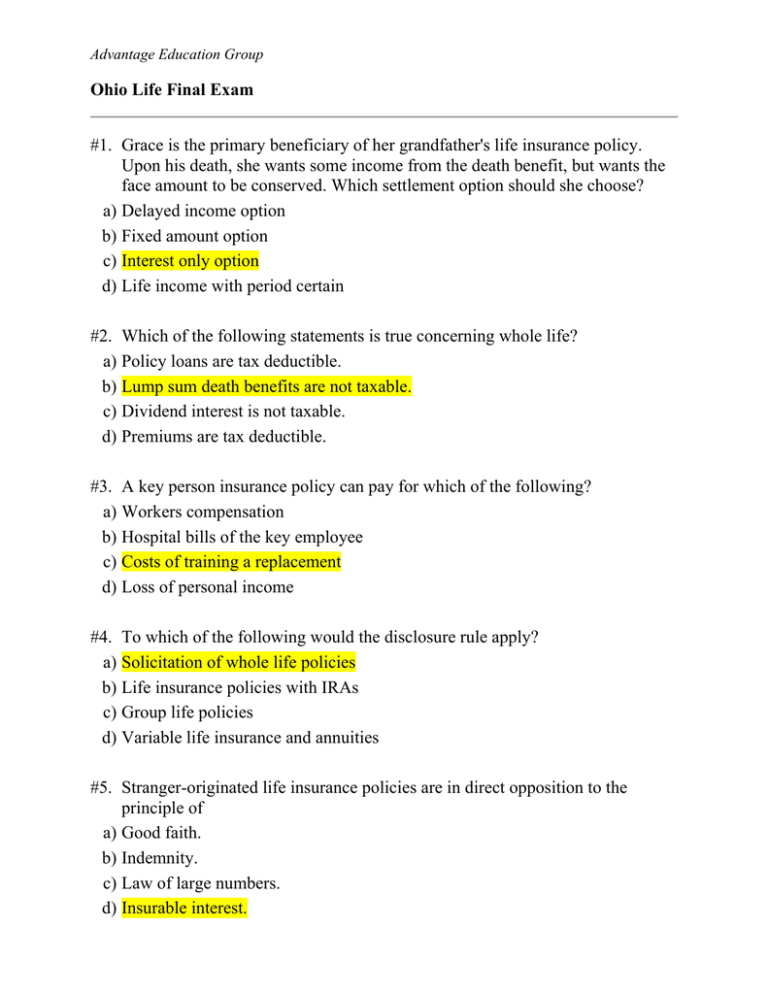

Solved Directions Choose The Best Answer To Each Question Chegg Com

Which of the following best describes taxation during the accumulation period of an annuity.

. Equal cash flows at equal time intervals for a specific time period. Uniform payments and equal time intervals such as months quarters or years are the two characteristics that make a series of payments an annuity. The term that best describes an annuity due is the payment at the beginning of the year.

B a series of unequal cash payments made at equal time intervals. An ordinary annuity is a series of equal payments made at the end of each period for a. Which of the following best describes the nonforfeiture value of the annuity.

C The growth is subject to immediate taxation. A an investment which produces increasing cash flows over time. A series of payments to be received at a common interval during a period of time.

Which of the following statements best describes an ordinary annuity. Payments at the end of the year is known as a regular annuity. An insurance policy for retirement.

Through annuitization your purchase payments what you contribute are converted into periodic payments that can last for life. What else is an annuity best described as. A series equal payments to be received at a common interval during a period of time.

The growth is subject to immediate taxation. A series of unequal cash payments made at equal time intervals. A series of payments to be received during a period of time.

Which of the following best describes an annuity due. The surrender value should be equal to 100 of the premium paid minus any prior withdrawal and surrender charges. The present value of a set of payments to be received during a future period of time.

An investment which produces increasing cash flows over time. Which of the following best defines the purpose of the NAIC Annuity Suitability Model Regulation. An annuity is a long-term investment that is issued by an insurance company designed to help protect you from the risk of outliving your income.

Lumpy cash flows at equal time intervals forever. Deposits are made at random whenever you have extra money into an account earning interest. Which of the following best describes taxation during the accumulation period of an annuity A The annuity is subject to state taxes only.

Lesson 8 Quiz Financial Markets 1. The annuity is subject to both state and federal taxation. They are approximately equal to zeroThey are very highThey are strongly negativeThey are changing for the first time in the last 100 years 2.

A Prevent the beneficiarys reckless spending of the death benefit. Which of the following most accurately describes an annuity. C Pay the death benefit in fixed-amount or fixed-period payments.

Annuities provide guaranteed income for life by systematically liquidating the sum of money that has accumulated in the annuity. Equal cash flows at equal time intervals forever. B Allow the beneficiary to change to another option when insured dies.

A stream of equal cash payments made at equal time intervals d. The annuity is subject to state taxes only. An annuity is a series of payments of equal size at equal intervals.

See what the community says and unlock a badge. 10-14 Which one of the following statements. Equal regular deposits are made into an account earning interest.

Payment at beginning of year. B The annuity is subject to both state and federal taxation. Which of the following describes current short term interest rates.

Lumpy cash flows at equal time intervals for a specific time period. Which of the following best describes an annuity. If the series of payments is of different values.

A term that does not apply to mortgage payable or bond payable c. Multiple Choice C Series of cash inflows of varying amounts collected at the end of each period O Series of cash flows of equal amounts collected at the end of each period Series of cash flows. C a stream of equal cash payments made at equal time intervals.

Which one of the following statements best describes an ordinary annuity. Which Of The Following Most Accurately Describes An Annuity. The purpose of this regulation is to require producers as defined in this regulation to act in the best interest of the consumer when making a recommendation of an annuity and to require insurers to establish and maintain a system to supervise.

The accumulation phase is the pay-in period during which premiums are paid into the annuity. What is the Federal Funds Rate and how long. A lifetime income provider to a retiree.

A deferred annuity is surrendered prior to annuitization. A series of unequal cash payments made at equal time intervals b. Which Of The Following Best Describes The Structure Of An Annuity.

A lump sum is deposited into an account earning compound interest. An annuity is a series of equal payments and hence decreasing or increasing payments are not an annuity. The Spendthrift Clause of a life insurance policy is designed to do all of the following EXCEPT.

Which of the following most accurately describes an annuity. A stream of equal cash payments made at. Annuities are most accurately described as a stream of equal cash payments made at equal time intervals.

An alternative to certificates of deposit. An investment which produces increasing cash flows over time. D Taxes are deferred.

Equal cash flows at equal time intervals for a specific time period. A term that does not apply to mortgage payable or bond payable. Asked Sep 24 2015 in Business by MangaLover.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

Calculating Present And Future Value Of Annuities

Pdf Multiple Choice Questions Chapter 1 Introducing The Firm And Its Goal Mithlesh Prasad Academia Edu

0 Comments